Building trust for the future of data sharing

Background

Consumers need to share sensitive financial data for availing services like loans, managing expenses or investing. New government-licensed apps called Account Aggregators (AA) were introduced in India to digitally share personal data safely. This method is novel because it gives users control of their data. Users are able to see who has access to what data and can even revoke consent.

Problem

User Problem: How might fintech consumers trust and adopt this new method of sharing data via Account Aggregators?

Business Problem: How might fintech services reach a larger audience by leveraging Account Aggregators?

Solutions

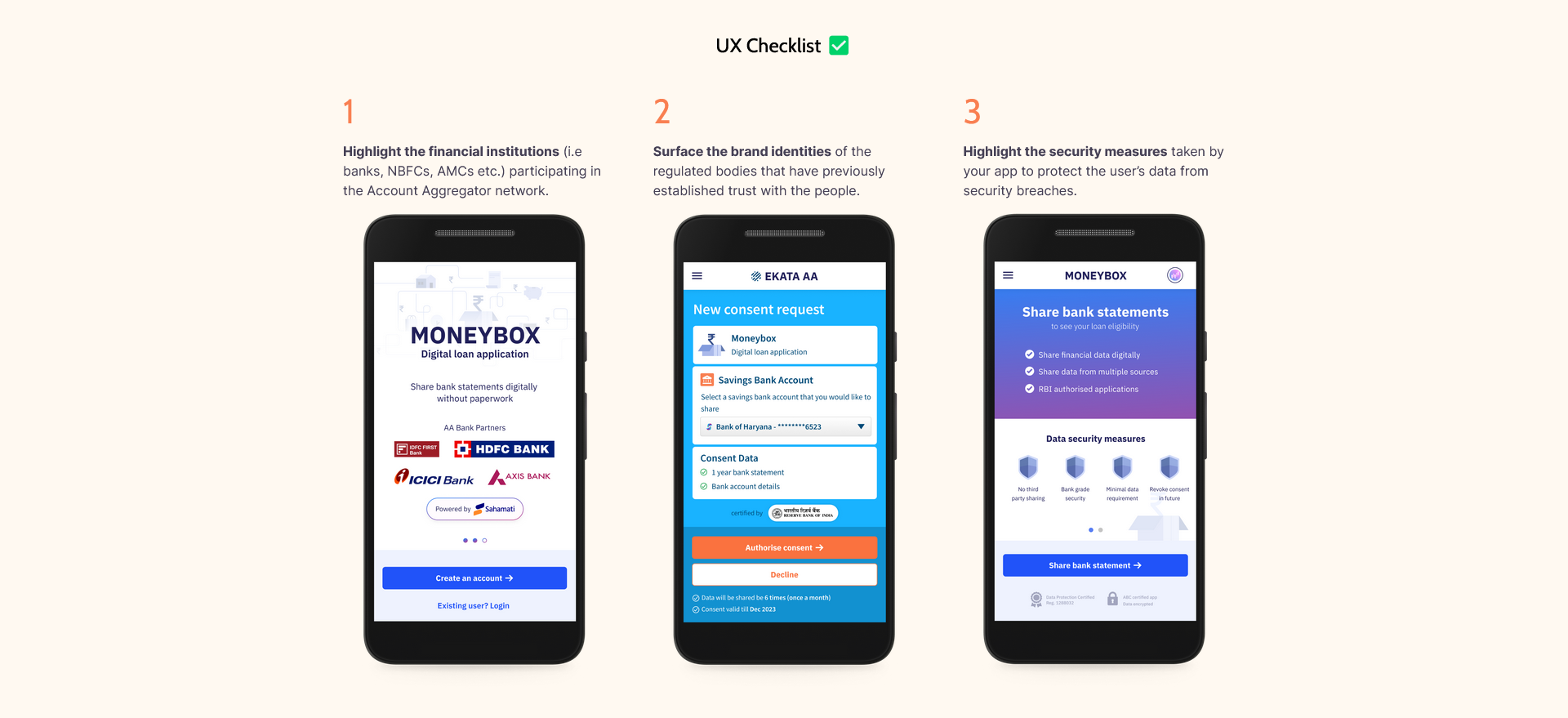

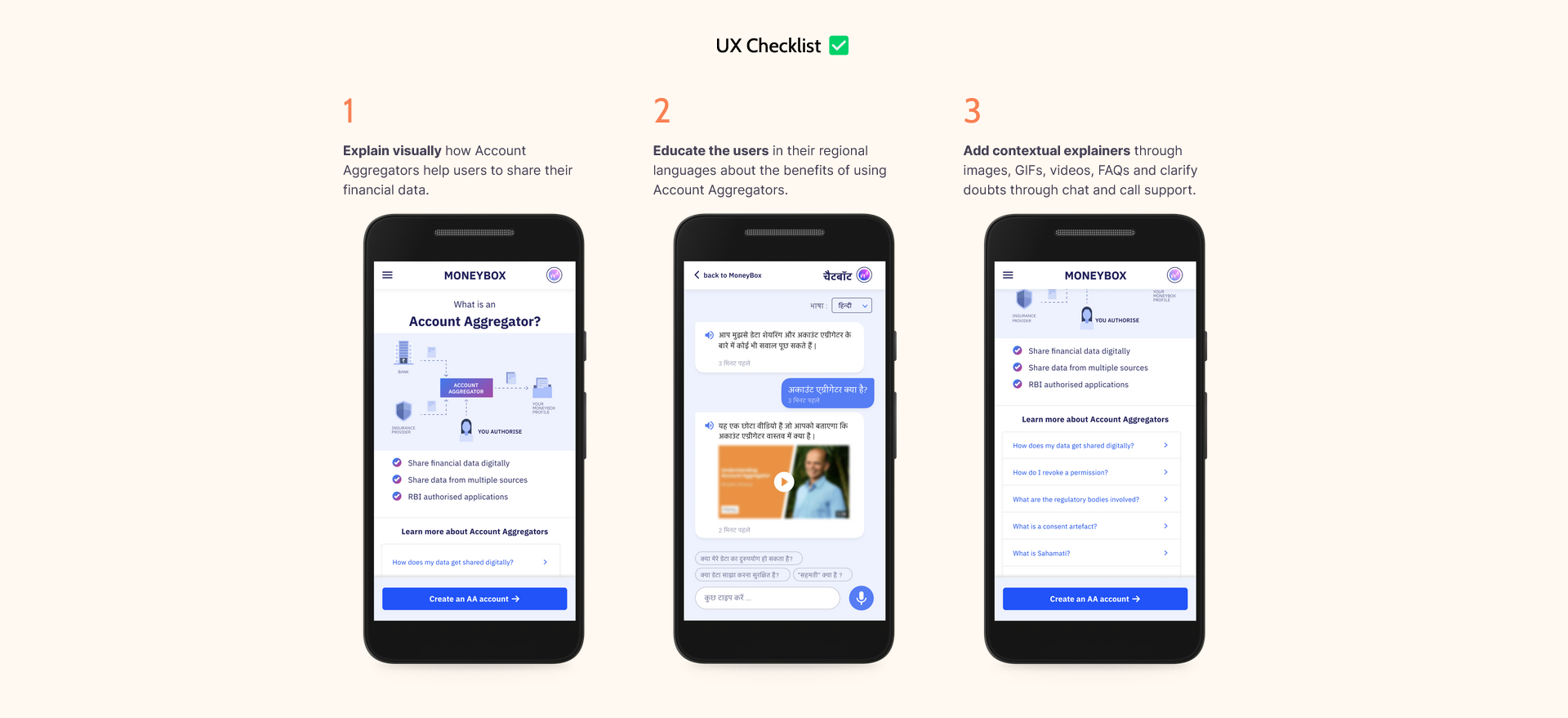

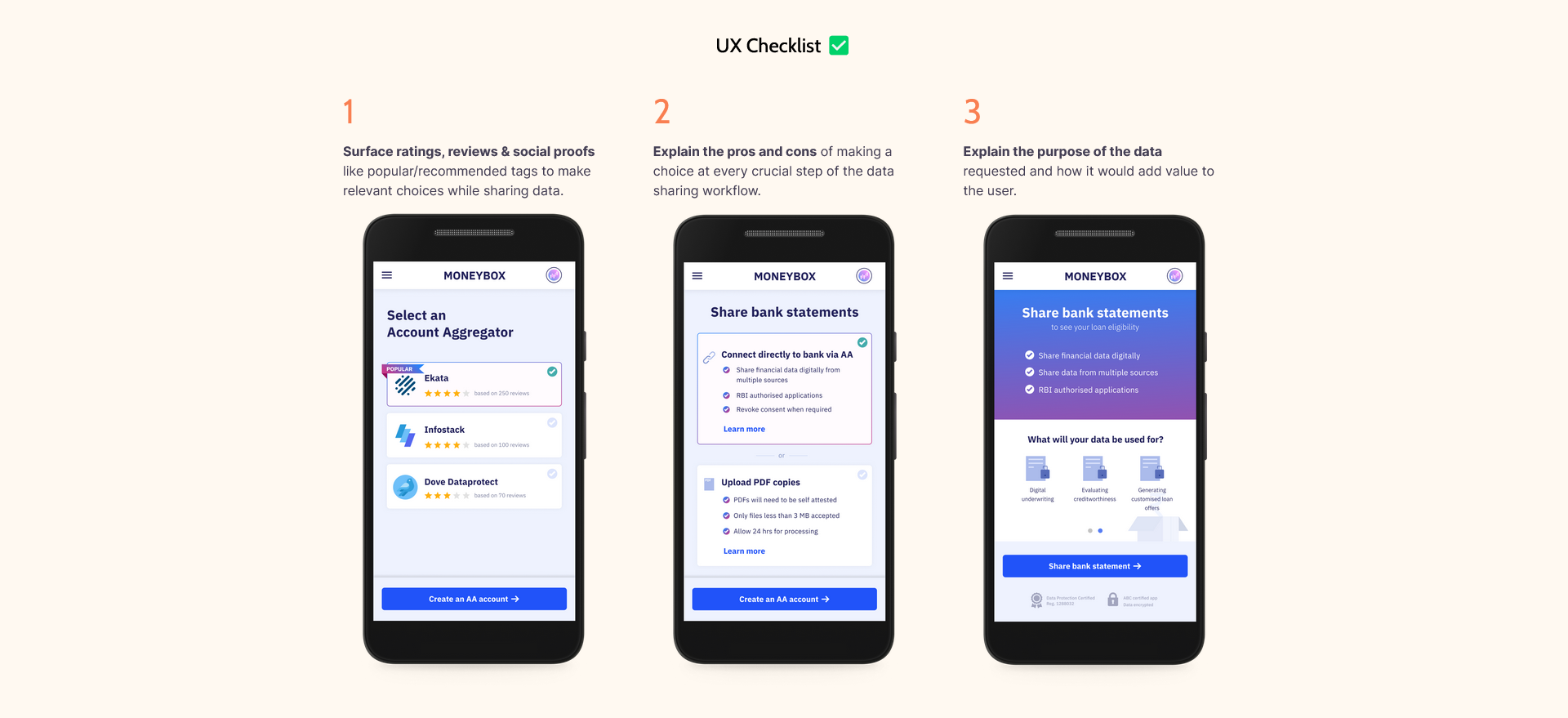

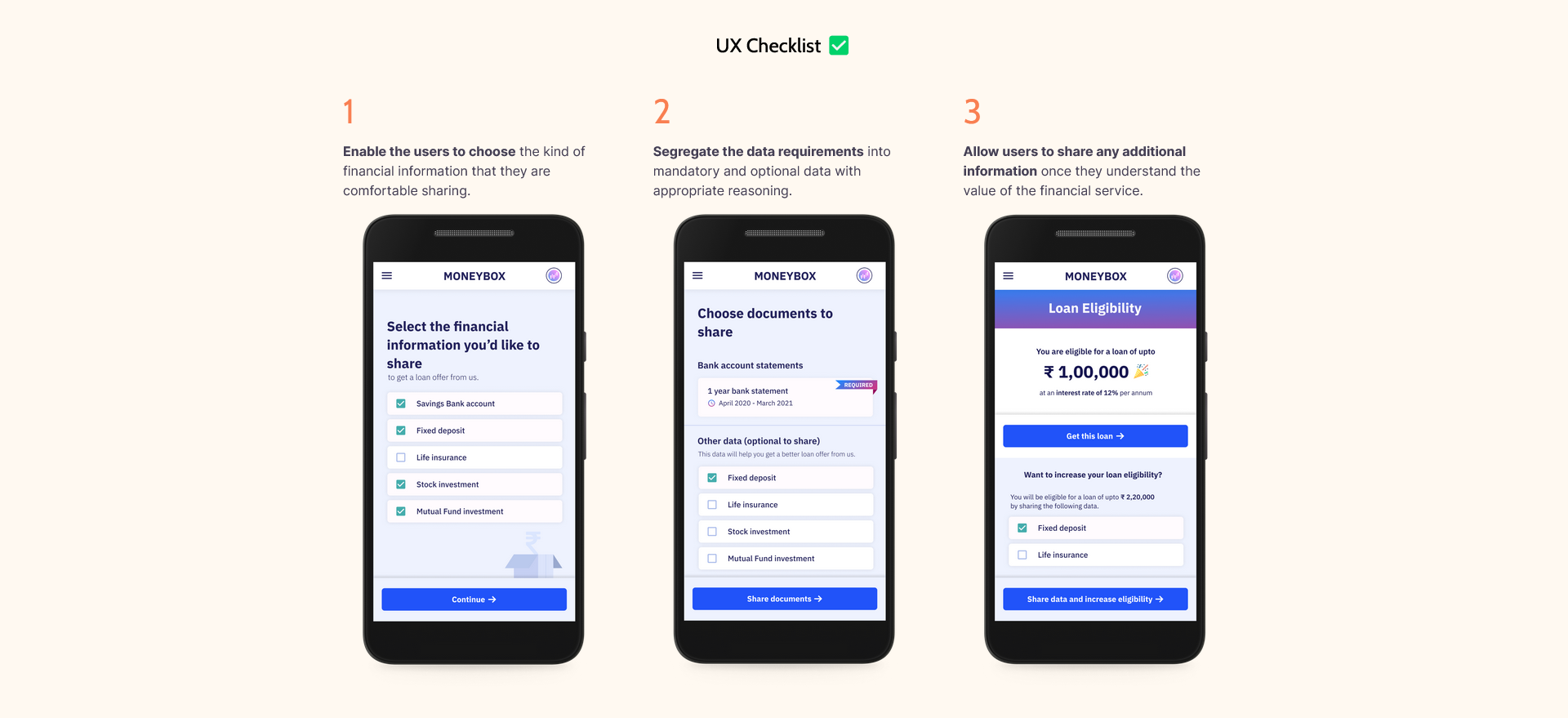

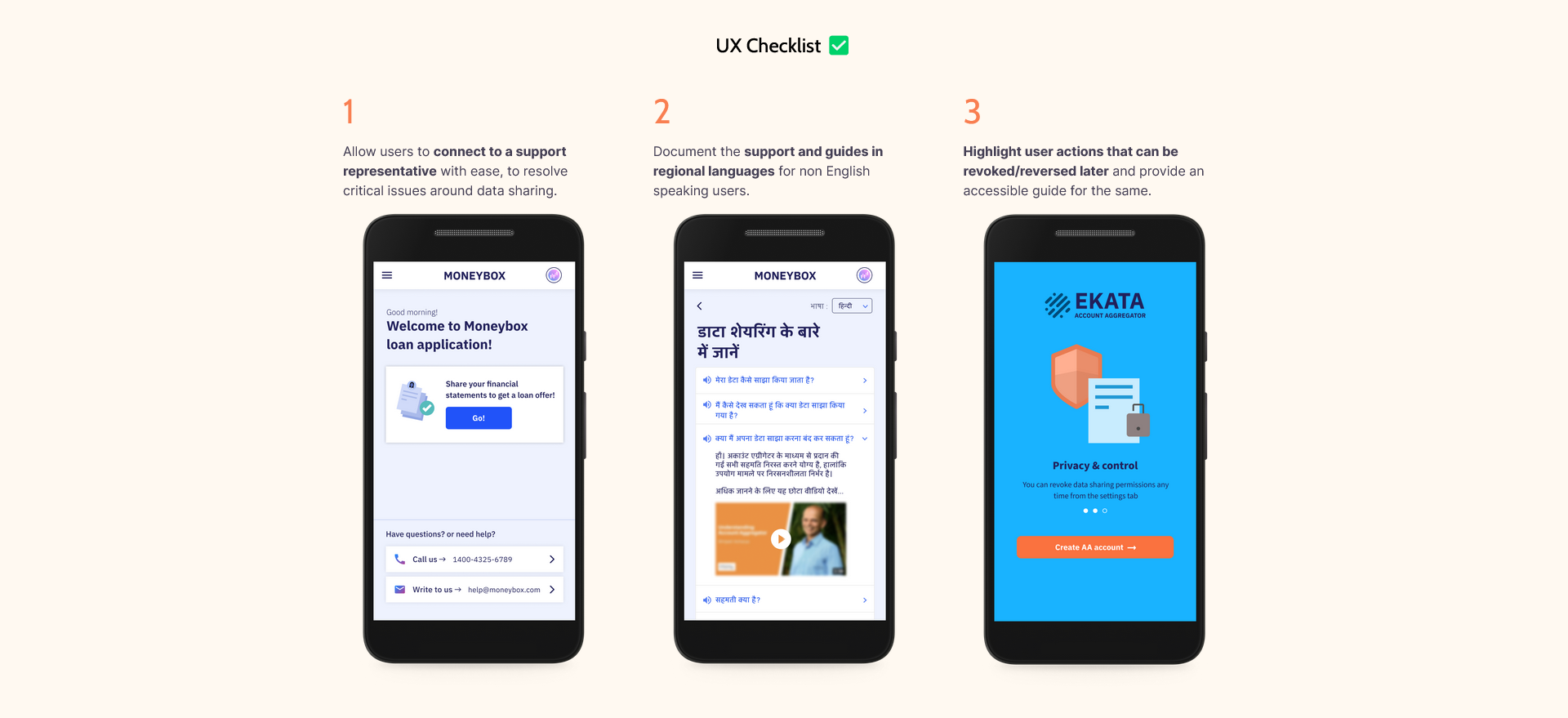

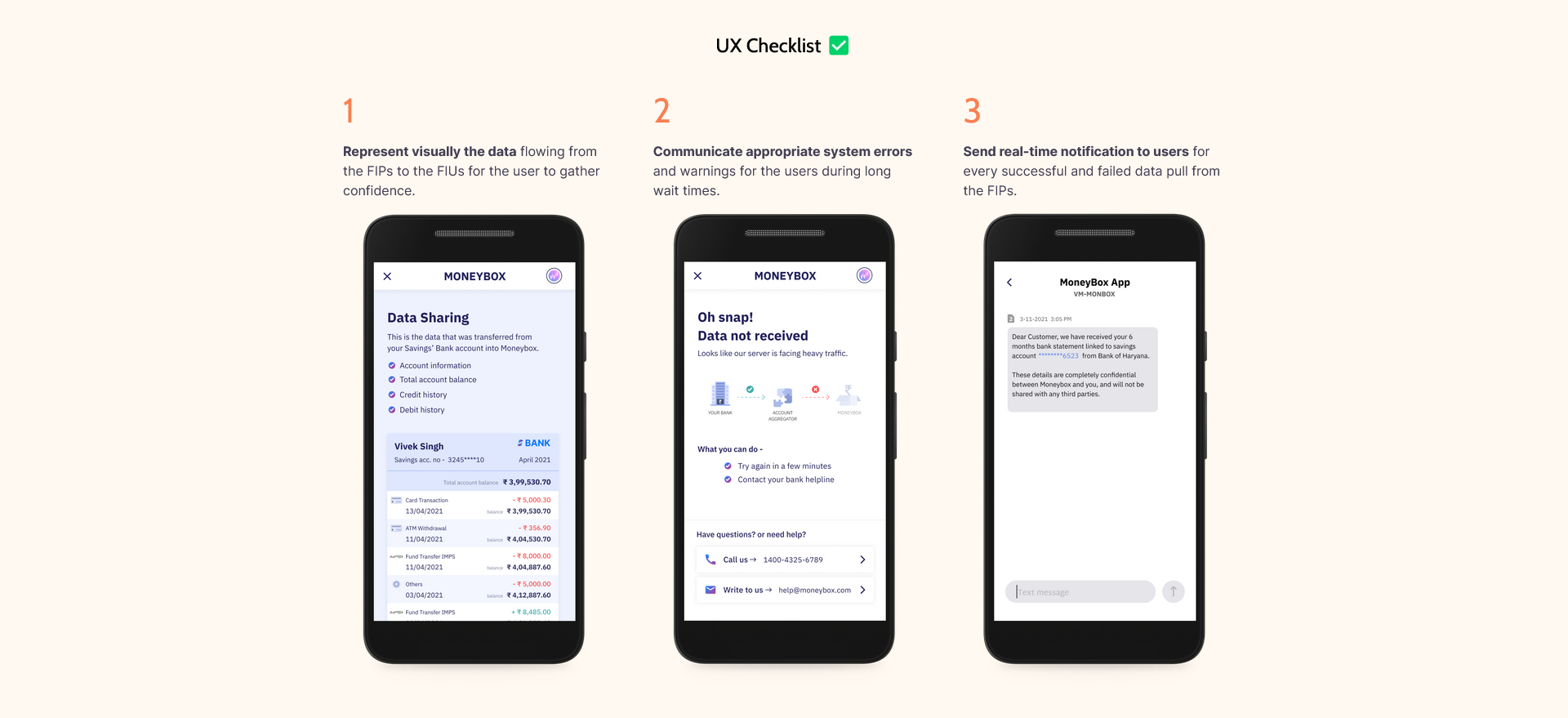

A UX playbook with 6 design principles and examples of how trust can be built with fintech consumers for sharing data via Account Aggregators

Impact

This is the first ever set of design principles laid out for fintechs in the Account Aggregator ecosystem. It sets a good inclusive precedent without dark patterns. Prototypes from this project have been published by Sahamati (official organization that promotes the Account Aggregator ecosystem in India).

My role

Derived UX principles by synthesizing data gathered from usability testing

Prototyped and usability tested data-sharing UI flows for use cases in lending, expense management and investing

Derived user personas by collaboratively synthesizing data gathered from user interviews

Conducting and transcribing in-depth user interviews

Co-organized a virtual design jam in collaboration with external stakeholders - facilitated workshop exercises for teams and coordinated asynchronously with all teams

Published user stories, articles, expert roundtable notes and newsletter edition online

Collaborators

Charu Chadha (Policy Manager, Meta) • Saranya Gopinath (Founder, DICE) • Robin Dhanwani (Founder, Parallel) • Dharmesh Ba (Research Head, D91) • Soumitro Datta (Researcher, D91) • Geetika Shukla (Graphic Designer, D91) • Prajna Nayak (Graphic Designer, D91)

Understanding the ecosystem

In December 2019, India redefined the ownership of personal data with the introduction of The Personal Data Protection Bill (passed as law in August 2023) defining the rights individuals have over their personal data, and the responsibilities of entities accessing user data.

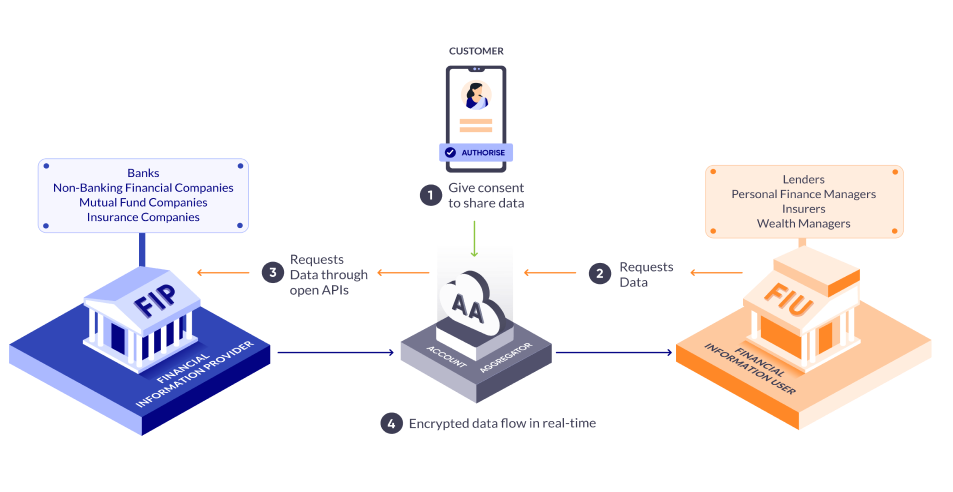

With the advent of Account Aggregators (AA), customers no longer have to stand in long queues or run from bank to bank gathering statements to support their business loans. AAs provide faster, safer and self-approved sharing of financial data at the click of a button.

Source: Sahamati

When the customer gives consent to an AA, it collects their digital financial data from one or more accounts, and delivers it to the financial institution that is providing services like loan or insurance.

Pros

+ AA shares data only with customer consent

+ All data is encrypted with the AA

+ AA can’t store or process customer data

+ Revoke consent to shared data any time

Cons

- New and unfamiliar way to share sensitive financial data for customers

How might we help financial consumers trust and adopt Account Aggregators for data sharing ?

Dec

The process

Aug

User interviews

Expert roundtables

Personas

Synthesizing data

Jul

Prototyping

Sep

Oct

Nov

Design Jam

Jan

Usability Testing

UX Principles

Synthesizing data

Publishing user stories and informative articles

Mar

Report and website

Feb

User interviews

Objective

Understanding goals, motivations and challenges in sharing personal data with financial institutions

Participants

Blue-collared and white-collared professionals from 4 different Indian cities varying in income level and ages 25-55 years

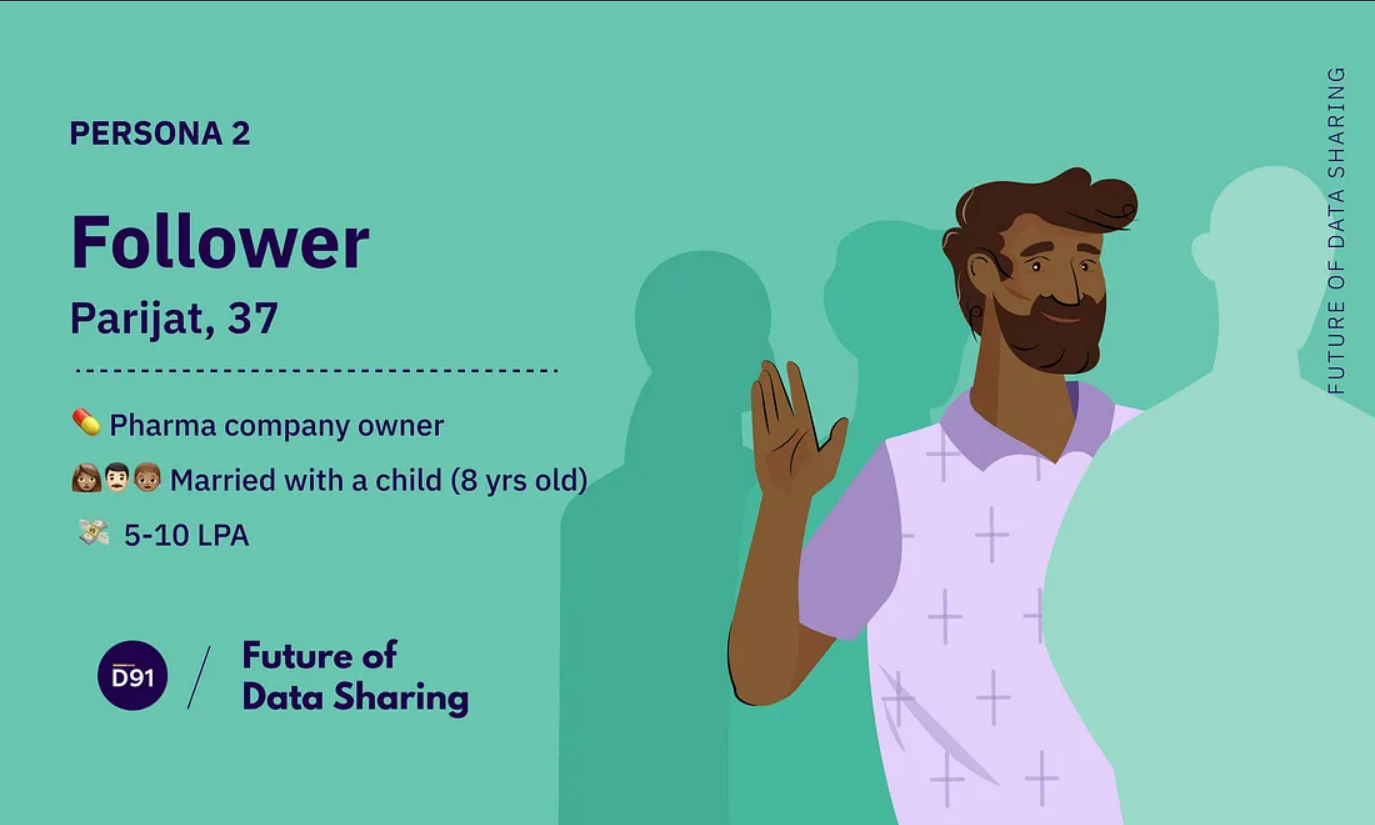

5 personas were derived after collaborative data synthesis based on their goals, financial and data sharing behaviors, tech literacy and decision influencers. Click each one to learn more.

Personas

“I am financially secure for now. I dream of buying a home some day. I would like to go for international trips and try out adventure sports like bungee jumping and paragliding for myself.”

“I’m planning to buy a new sedan within 2–3 years. I have other small goals like incrementally upgrading to a 2BHK and then a 3BHK.”

“When I have my own family, I would like my children to have a bright future. They should live in a good house. These days it’s also common to have a 2-wheeler for the family.”

“I’ll retire in 12 years. In my job, we don’t get much pension. Whatever I’m able to save now, I’ll put into FDs so that they can support us in old age. My son will hopefully be a working man himself by then.”

“I should be financially independent and stable. If there is any need, no matter what it is, I should have the money for it. I like to move step-by-step.”

Design jam

A 2-week remote design jam (hackathon) was co-organised in collaboration with Facebook, Parallel and Digital India Collective for Empowerment. We had 9 teams of various designers, product managers, founders, policy experts and facilitators. Each team was given one of the five personas and a fintech use case like lending, expense management or portfolio management with the objective:

‘How might we design a trustworthy UX for an individual to share data using AA?’

Designers

Product managers

Founders

Policy experts

9

Teams

Weeks

3-hour workshops

Async collaboration

Mentoring sessions

Final presentation

2

Use cases

Personal lending

MSME lending

Consumer durable loans

Expense management

Investments

5

Personas

Trendsetter

Follower

Aspirant

Survivor

Cautious

5

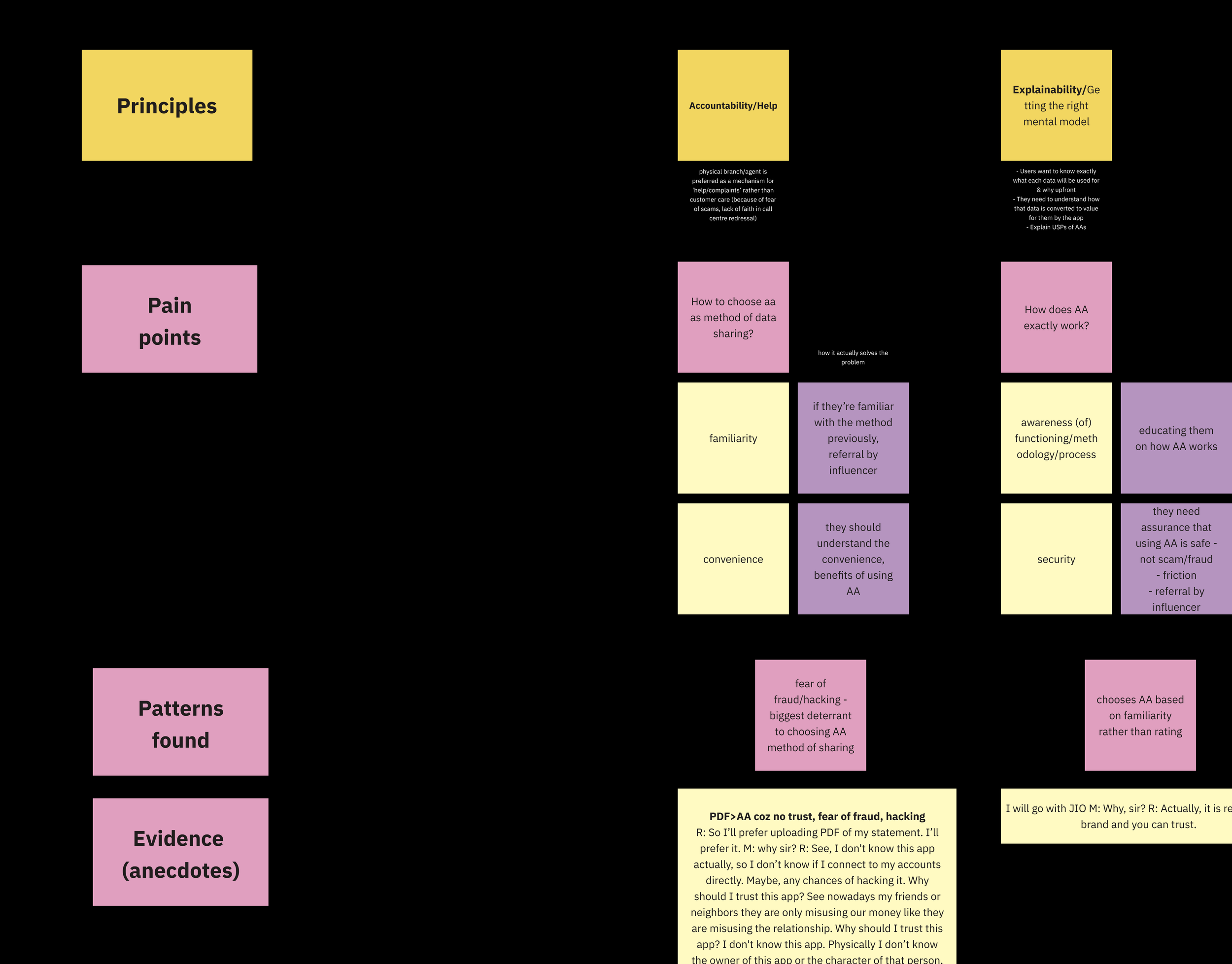

Interesting ideas came out of the design jam like using trust markers, conversational UI and educating users of pros and cons of various methods of data sharing.

Prototyping and testing

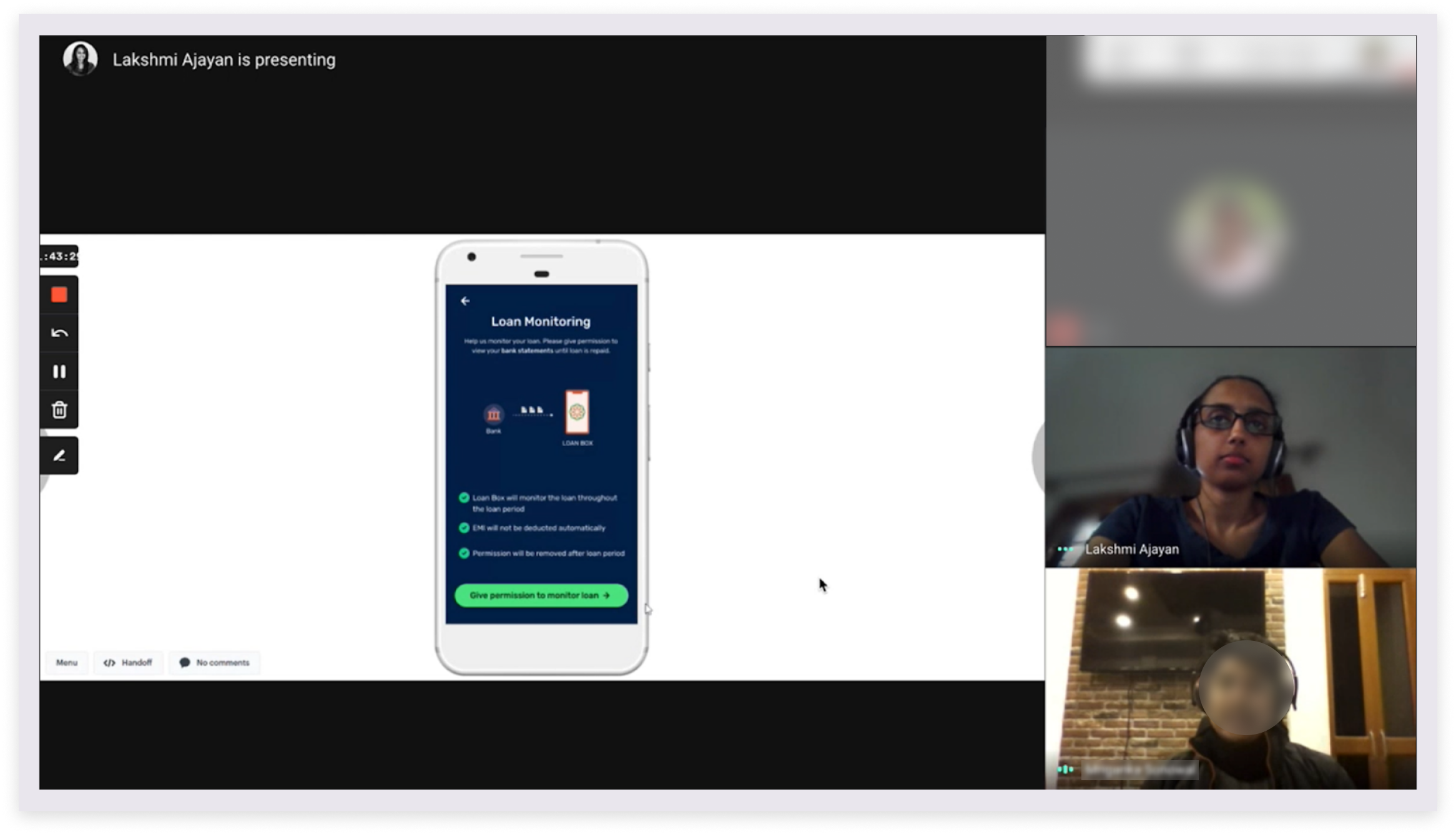

Solutions and ideas that were born from the design jam were usability tested with 10 participants through 3 prototypes, one each for lending, expense management and investing.

Do the users understand the digital financial product?

Do the users understand the idea of account aggregator?

Are the users willing to use account aggregator?

How are the users choosing the account aggregator?

What are the data that the users are willing to share through AA?

What are the users willing to trade off for better services?

What are the controls that the users are looking to have over their data?

Research objectives

Expense management app prototype

Each of these usability testing interviews were transcribed, coded and synthesised to derive patterns in users’ concerns and pain points. These patterns were articulated into 6 UX principles for data sharing via AA.